Finances. Budget. Banking. These words can bring a sense of doom regardless of your stage of life. When a person is retired, however, financial topics become even more challenging. Seniors often have fewer sources of income, and the aging brain can cause confusion. In this post, we’ll explore some issues people face with finances in retirement and how you can help your favorite senior in this area.

Discussing Finances In Retirement

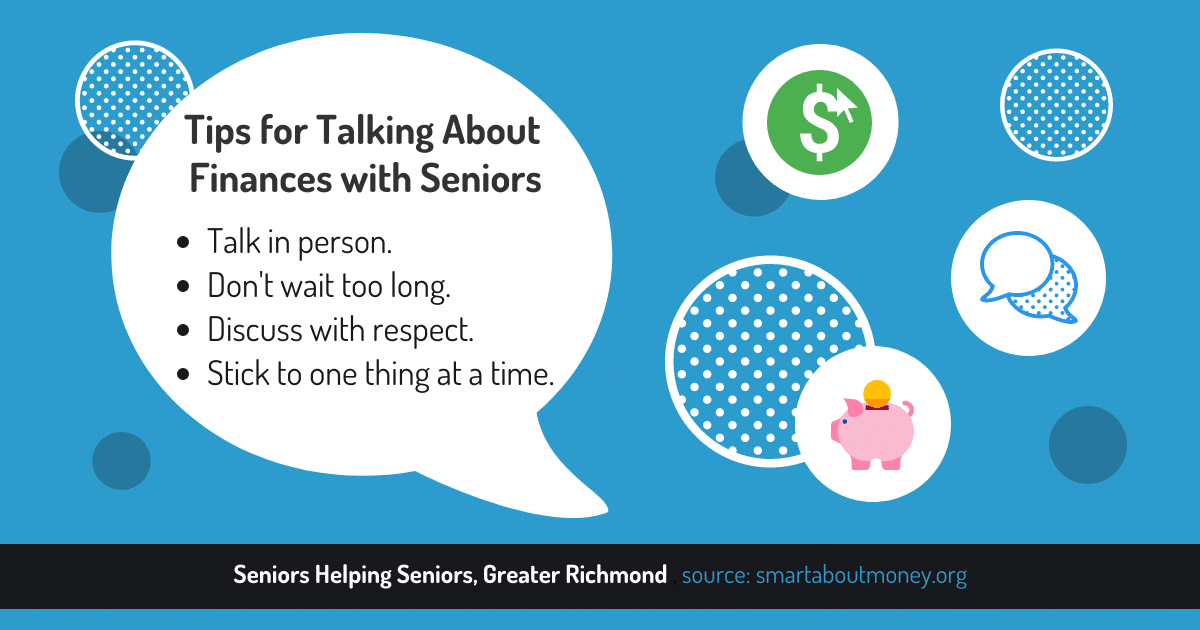

Let’s face it. Most people prefer not to talk about finances, particularly with their aging parents. The subject can be even more challenging for those in the sandwich generation. You already have your own family’s budgeting needs, and focusing on those of your parents just heaps on the stress. While broaching the subject of finances with an aging loved one presents plenty of challenges, you can make it easier with a few tips. An article from Smart About Money offers these suggestions:

- Talk in person. If you live far away, save this discussion for when you take a trip to visit.

- Don’t wait too long. You can still have this conversation when your parents seem fit and independent. When they start to decline, you’ll be ready with their preferences.

- Discuss with respect. Remember that being judgmental or preachy will put your loved one on the defensive.

- Stick to one thing at a time. If they seem reluctant, gently talk about one topic at a time to prevent overwhelm.

Learning Online Banking

One thing that may help your senior loved one feel more in control of finances is helping him or her learn about online banking. With many older citizens unable to get out to the bank without help, being able to take care of things from home allows them to feel like they can do what they need without bothering someone to take them out to the bank. Fortunately, the pandemic forced many seniors to learn how to use their bank’s online platform because they had little choice. Capital One has a great article with some tutorials on helping seniors with online banking.

Budgeting in Retirement

We can’t discuss finances in retirement without mentioning the need for a budget. Seniors who are healthy and active may find budgeting easier if they get a fulfilling, part time job (such as with us at Seniors Helping Seniors). Not only will they earn some extra income, they will fill social needs, as well.

Some seniors have a hard time adjusting to the fact that they just don’t have as much income as they once did. Lay it all out for them. It helps to track their spending for a couple of weeks to raise awareness of where their money actually goes. Once they see how much money comes in vs how much goes out, they will realize the need for a budget.

Another important consideration is making sure everyone is informed. According to an article from Intuit, many family squabbles arise when one family member thinks another is trying to hide something. If you have siblings, communicate your intentions about helping your parents. When everyone is informed and on the same page, you can avoid conflict and have a team approach.

We’d love to hear your tips for helping seniors with finances in retirement. You can join the conversation over on our Facebook page.